eCommerce

October 29, 2020

5min Read

lulujanah

“Do I need a business license to sell online” is a question that a lot of people ask before opening an eCommerce business. If you’re just starting a new business, all he legal documents needed can be overwhelming.

Fret not, in this article, you’ll learn all about the types of business licenses, and, where and how to get them.

What Is A Business License and Do I Need A Business License to Sell Online?

A business license is a government issued certificate that allows people to own and operate a business. There’s not much of a distinction between a regular brick and mortar store and an online store in the eyes of the law. Without a license, your state or city may halt your business until you achieve all the requirements to own one.

That is why applying for a business license is one of the first things you should do. However, in several specific areas, you may not need a business license until you hit a certain revenue threshold. Be sure to keep yourself informed on the local laws.

Licensing is fundamental to your eCommerce growth. Having a legitimate business will help you acquire loans and partnerships more easily. On top of that, it enables you to claim some expenses as tax deductions.

Most licenses are paid, this way, the government can supervise the enterprises operating within the specified jurisdiction.

Difference Between Business License vs. Seller’s Permit

You may have heard about seller’s permits. Other known terms are the sales tax permit or the sales and use tax permit.

Generally, if your goods and services qualify for sales tax, you must get a seller’s permit. With it, you can collect and remit taxes from your end customers.

While you have to pay to license a business, it’s free to obtain a seller’s permit. If you are looking to sell at a particular location for a shorter period, some states also provide temporary seller’s permits that last for 90 days.

A seller’s permit also allows to buy products from suppliers or manufacturers without paying any taxes. If you have a resale certificate, you can start selling things online at the wholesale or retail level.

If you’re distributing to different states, you should be aware of nexus. The sales tax nexus will be determined by the total revenue you generate in each state with which you have nexus or a connection.

What Business Licenses and Permits Do You Need?

Depending on your online business’s location, size, and nature, you may need some or all of the following licenses:

- Federal business licenses. This license is compulsory if you sell anything under the supervision of government agencies like the Food and Drug Administration. Tobacco and alcoholic beverages, for example, are products that fall under this category.

- State business licenses. Usually, the state requires licenses for specific industries, such as a contractor’s license or an accountant’s license.

- Local business licenses. These include zoning permits, occupancy permits, and other licenses regulated by the city or country.

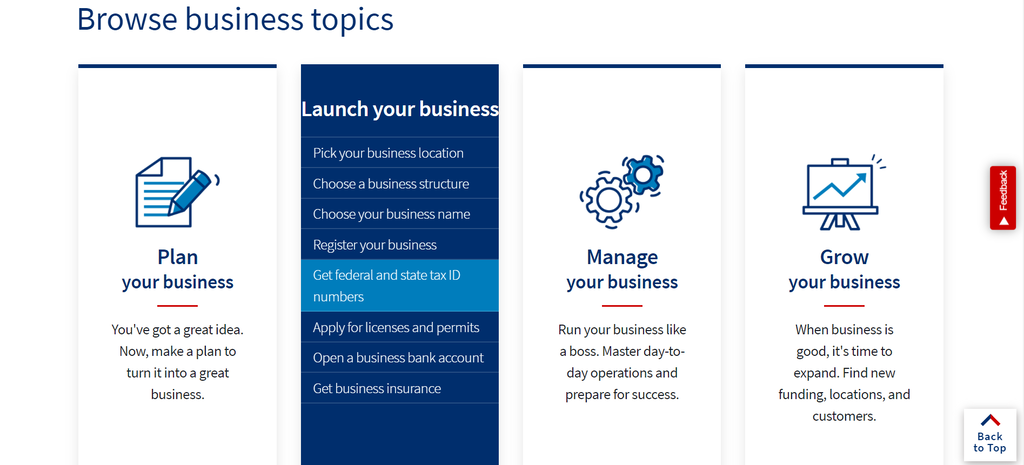

It’s important to note that the rules around business licensing vary from one state to another. For more information, visit the Small Business Administration (SBA) website.

The same applies if you’re selling internationally as you’ll need to make sure your business practices are in accordance with the local laws of your target country.

The same applies if you’re selling internationally as you’ll need to make sure your business practices are in accordance with the local laws of your target country.

Business license requirements are not only limited to those selling at physical locations. Even if you manage a home-based online business, there are some rules you must comply with.

Numerous states, for instance, require a Home Occupation permit. It’s also possible that you need a manufacturing permit if you’re sourcing products yourself.

Can You Sell Products Without A License?

In case you’re occasionally selling a limited amount of products, such as handicrafts or artwork, you don’t need to acquire any licenses or permits.

However, if you engage in regular business activity without registering yourself for the appropriate licenses, your online business is violating the law and is operating illegally.

As a result, you’ll receive a fine, the severity of which depends on your state laws and business model.

Even if you try to apply for a license after such an incident, there is a chance that the government won’t grant your request, prompting you to stop your operations.

Moreover, your business will lose its reputation. Unhappy customers may even prompt lawsuits because you can no longer fulfill your orders.

What about Online Services?

Whether you’re selling products or providing services online, having a tax license is necessary. Be sure to check the rules concerning taxation in your state.

In case there is a service tax, the cost will approximately be the same as for other taxable products.

Generally, you’ll also need a seller’s permit. Watch out for any other special permits that you may need.

For instance, if your company is working in the food industry, you may also need a food service permit, a health permit, and a manufacturer’s permit if you’re producing foods on your own.

Other Business License Types You Might Need in Order to Sell Online

Business Operation License

To register your online business, you’ll need to turn in an application and pay a small fee to a licensing division.

If you live in the US, remember that each state enacts different regulations. You’ll need to check with the local City Hall or Secretary of State Website to determine the requirements.

Typically, you have to renew your business licenses annually or bi-annually. Remember to check the licensing authority website periodically to ensure whether your business still meets the qualifications, or else you might end up having to pay some fines.

Employer Permit and Licenses

If you have no employees and are a sole proprietor, you can use your Social Security number for tax identification purposes.

However, if you hire employees, your business requires a federal Employer Identification Number (EIN). This tax ID number identifies your business as a tax entity, ensuring that your company collects payroll tax and stays compliant.

You can file for an EIN on the International Revenue Service website.

Furthermore, your company may need to apply for unemployment insurance and workers’ compensation. These permits are crucial to protect your workers.

Doing Business As (DBA) License

If you plan to operate your business using a different name from your own, you’ll need a DBA license. This license makes it clear to the government and the customers who is behind the business.

In Los Angeles, California, for example, having a DBA is mandatory for starting a business.

A DBA is also necessary for opening a business bank account and establishing contracts.

Should you want to file a DBA, head to the nearest county courthouse. The cost of the form ranges between $25 to $100.

Occupational License

An occupational license regulates various professions that require training and utmost competency, as the wellbeing of both infrastructure and people rely on them.

This type of license affects a range of fields – from real estate, plumbing, doctoring, financial planning, construction, transportation, to food preparation.

To identify whether you need a business license of this kind, refer to the National Occupational Licensing Database.

Weight and Measures Registration

Businesses that involve weighing objects in their selling activities may require weights and measures permits.

Since the rules regarding this type of business permit are specific within each state and city, make sure to consult the relevant authority.

How to Apply for A Business License

In order to apply for a business license, you will need to talk to your city planning representatives and ask for a zoning permit.

The relevant branches of your state and city will then perform a zoning review of your business location. More complex licenses, such as the situations of combined online and brick and mortar businesses, may require in-depth inspections.

Hence, you’ll need to ensure that you can operate your business without violating the local zoning restrictions.

There are several requirements to meet before opening your business. These include a legal structure – sole proprietorship or limited liability corporation, a detailed record of business activities, a sales tax permit, and other necessary licenses.

You can either fill the form online or pick it up manually. Once finished, you will need to send them to the relevant department.

Generally, your license should be ready in a couple of days or weeks.

Conclusion

If you ever wondered “do I need a business license to sell online”, the answer is yes.

Licensing for a business is critical to your eCommerce success as it prevents you from unwanted legal problems.

Other business permits that you’ll need for your eCommerce business are a seller license, reseller permit, tax license, and so on. For home-based businesses, getting a home occupation permit is a must.

Now that you know all about the necessary licenses and permits to start a business, nothing is stopping you from establishing one. Best of luck in developing your eCommerce store.