Despite decreases in in-store shopping, Capterra’s latest survey of 1,020 consumers reveals one silver lining: COVID-19 has driven the growth of online shopping in Australia. Consequently, businesses have had to pay more attention to their online presence and drive forward their digital offerings.

When the lockdown rules began to relax in May, Capterra Australia experienced a 47% increase in the number of business professionals searching for eCommerce software, in comparison to April. Retailers also took the opportunity to improve their delivery services, with the same period showing 61% more people exploring distribution software—a technology that manages processes such as inventory tracking and warehousing.

Now, the Australian retail industry is in the midst of yet another challenge—Melbourne closed all non-essential stores due to a spike in coronavirus cases. E-commerce operators, and retailers that fulfil online sales from in-store, are continuing to trade but through click-and-collect and delivery services.

While other areas of the country aren’t yet following in the steps of Victoria, there are cases of the world experiencing further waves of the virus, leaving many consumers wary to visit their favourite shops in person.

To help retailers prepare and adapt to changing consumer demands, needs and concerns, Capterra’s latest survey highlights five ways Australians are changing their attitude toward the retail and online shopping industry.

Key highlights from the survey:

- 62% of Australians plan to shop online more than they did before the virus.

- More than half (56%) will leave an online shop if it doesn’t offer their preferred payment method.

- 81% are concerned about online security threats when shopping.

- Around a third (31%) have already been victims of an online shopping scam.

The survey includes the responses of 1,020 consumers living in Australia. To read the methodology behind the survey, skip to the bottom of the page.

1. Australians plan to increase the amount they buy online

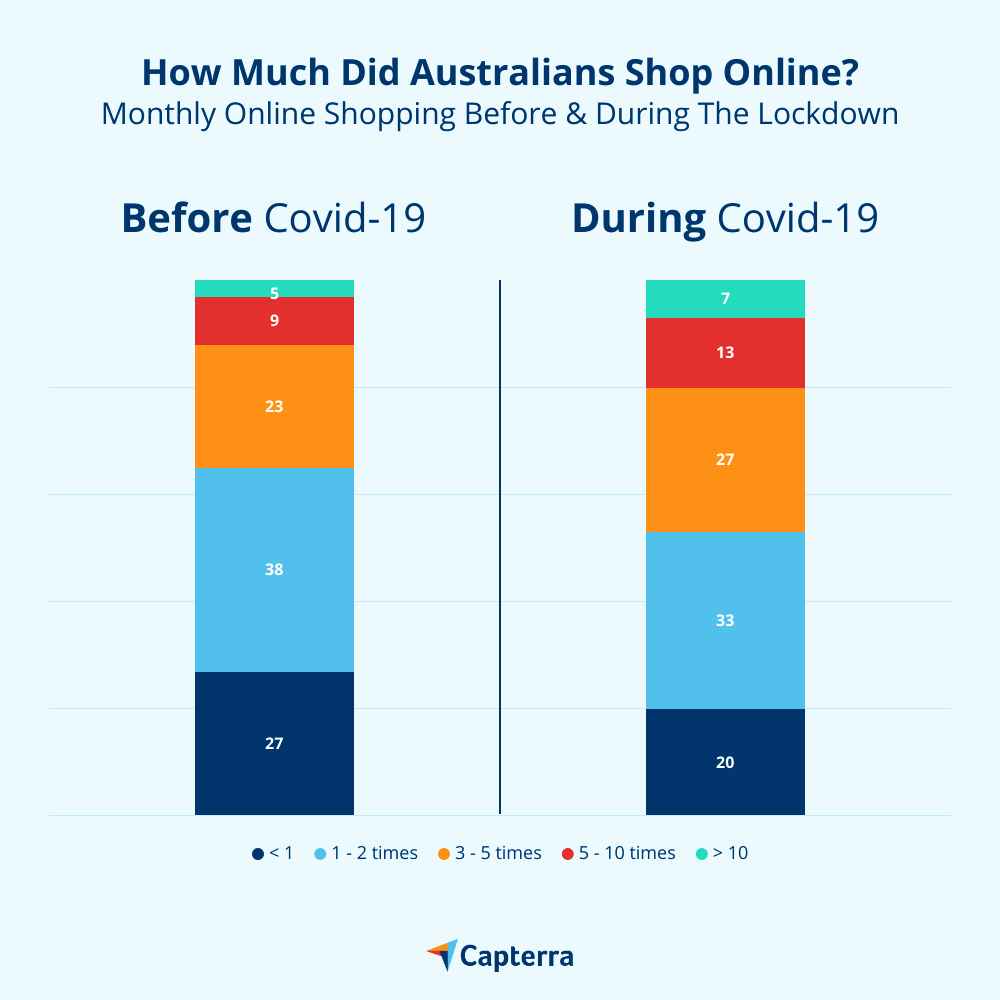

90% of respondents said they have shopped online at least once this year. Generally, however, the amount that people were shopping online increased during the country-wide lockdown:

Given that people were unable to leave their homes under strict social distancing measures, this increase makes sense.

However, instead of bouncing back to previous habits, Capterra’s survey indicates how this experience is shifting how Australians want to shop in the future. When asked whether respondents believe their shopping behaviour has changed for good due to the crisis, 62% said yes.

Of those respondents:

- 26% said they will buy more in online shops than before.

- 24% said they will buy products online that they used to buy in physical shops.

- 12% will avoid going to physical shops because of the risk of infection.

Key takeaway: Australian retailers should continue investing and improving their online presence.

Retailers must remember to communicate to customers how they’re keeping their services COVID-safe so that they feel comfortable to shop from them. One method of achieving this is by sending an email marketing campaign, using email marketing software, to all previous and current customers.

2. Security threats are a concern

Cybercriminals are targeting Australian eCommerce customers

Despite people leaning further towards digital shopping methods, 81% of respondents expressed some level of concern about the potential for security threats when buying online.

Unfortunately, since the lockdown, cybersecurity crimes have increased—and small and medium-sized businesses are regularly targeted. Focusing on online shopping experiences alone, 31% of respondents said they’ve been a victim of an online scam at least once. Men appeared to have been targeted more successfully than women in Australia, with 35% of male respondents falling into this bracket versus 28% of women.

eCommerce brands need to educate Australian shoppers on cyber threats

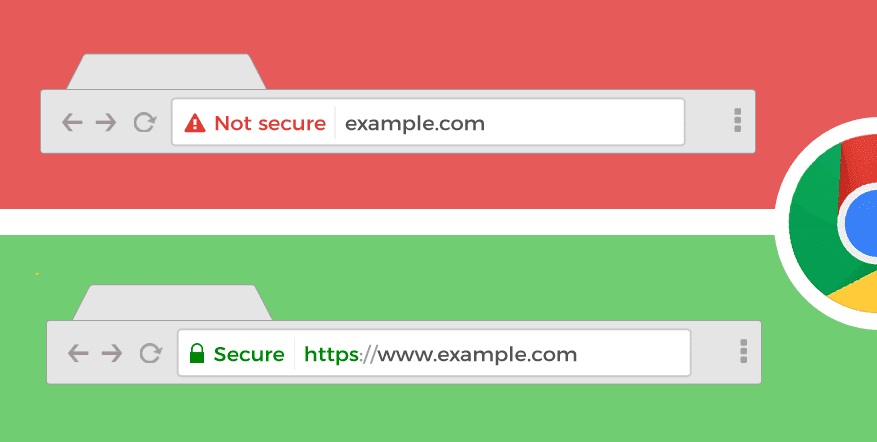

Despite a large majority of shoppers feeling anxious about the potential for cybersecurity on webshops, only 43% of respondents are checking websites for a secure sockets layer (SSL). A quick indication that a website has an SSL certificate is to check for the padlock icon in the search bar.

Gartner defines an SSL certificate as ‘an Internet security standard from Netscape Communications, used for its browser and server software.’ In other words, once an eCommerce shop is set up, adding an SSL certificate to the website helps secure it by stopping hackers from private company information—such as customer credit and debit card details.

Worryingly, 29% of respondents said they make a snap-judgement of the online shop’s security based on the look and feel of the website. Sadly, there has been a rise in cases of scam websites marketing fake products—often related to coronavirus. The aim behind these sham websites is to obtain personal information, as well as credit card details, from unsuspecting consumers.

Key takeaway: Consider the vulnerability of customers and mitigate cyber risks

Many eCommerce software platforms include SSL and HTTPS as a standard with their free web-hosting offerings, but retailers should always double-check this when choosing a provider.

ECommerce operators could also do more to educate their customer base on other ways to spot potential threats. For example, using an email campaign to teach phishing emails exploiting your brand name. Also, it’s a good idea to encourage customers to change their account password every six to twelve months.

3. Despite online shopping increasing, Aussie consumers are sticking to what they know

While COVID-19 drove the growth of online shopping in Australia, 69% of respondents said they’re not exploring emerging shopping technologies. Of the respondents that had, the most popular methods were;

- Social media (18%)

- Voice assistants (11%)

- Chatbots (10%)

- Cashier-less stores (3%).

One example of a cashier-less store is Amazon Go’s Just Walk Out store. With an app installed, in-store shoppers can buy products without having to queue to pay at a checkout till. The technology automatically detects when products are taken from or returned to the shelves and keeps track of them in a virtual cart. When the shopper is finished buying, they can simply leave the store. Anything they take with them is charged to their account.

The Just Walk Out store isn’t yet available locally in Australia—which could be why many Aussie consumers haven’t yet participated in this kind of shopping. However, the concept of it has certainly piqued the interest of some shoppers: 56% of respondents said they’d like to try this style of shopping.

Those that were opposed to the idea put it down to not wanting to feel monitored (21%) and because they preferred the classic, in-store shopping experience with human interaction (23%.)

Key takeaway: Blend traditional online shopping methods with emerging technologies

The Australian retail market is primarily on traditional online platforms, where consumers can use a web browser or an application. For businesses that are fairly young in the eCommerce sector, it’s worth perfecting these channels first before investing heavily in newer technologies.

Bear in mind, however, that these channels will continue to integrate further into the online shopping experience and there is great potential in them. Taking social media as an example, fifteen million Australians have a Facebook account and more than nine million have an Instagram account according to SocialMediaNews, making it an exciting space for retailers to tap into.

4. Having the right payment options available is important

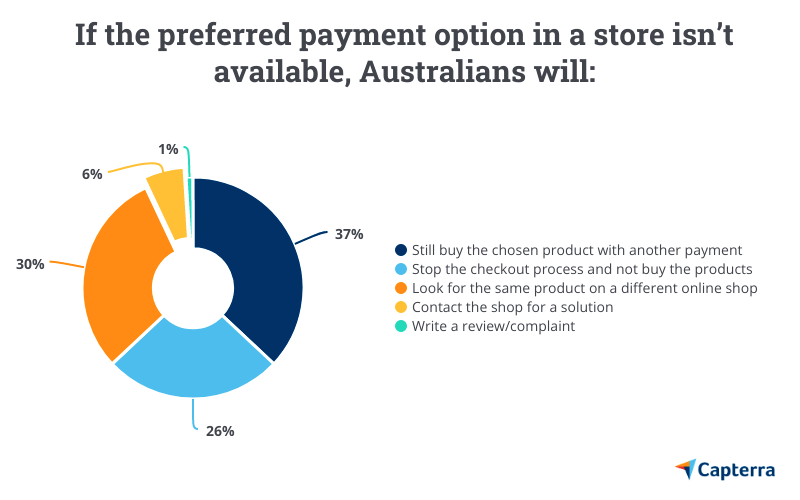

More than half (56%) of online shoppers will leave an online shop if it doesn’t offer their preferred payment method—from coins and notes through to digital alternatives.

Everyone has a different preference when shopping online. By offering a wide range of options in the checkout process, retailers set themselves up to drive more sales and reduce shopping cart abandonment.

Key takeaway: The payment gateway on an online shop should be a priority to eCommerce operators.

As a bare minimum, webshops should ensure they include the below options (which were voted by respondents as the top five payments preferences):

- Online payment services like Paypal, V.me: 55%

- Credit card: 45%

- Debit card: 37%

- Pay afterward: 15%

- Mobile wallets: 14%

Shopping cart software is a good starting point for retailers that want to enrich the customer’s check-out experience online.

5. Australians still value the in-store shopping experience

The Australian high street may be struggling, but consumers still desire and enjoy the in-store shopping experience. Almost two-thirds (63%) said they even prefer it to online shopping.

Top five reasons provided included that they:

- Prefer the shopping experience of the physical shop: 63%

- Can take the product instantly and not have to wait for delivery: 45%

- Are supporting the local economy: 39%

- Prefer human contact with the sales assistant: 24%

- Like to discover new products in a physical shop: 20%

Retailers should take note that much of the in-store enjoyment stems from the experience. For example, seeing and feeling a product before taking it home is impossible to replicate online, but something consumers still value.

15% of respondents also said sustainability is another reason they prefer in-person shopping. Shop owners should consider how they can convince consumers of the sustainable payoff of buying a product in-store. Expedited shipping, for example, often requires air travel which feeds into the carbon emissions problem. In that respect, ground transport has a marginal, but significant, environmental victory.

Key takeaway: Revitalise the in-store experience and hone in on its benefits

It’s worth stores refreshing—even reinventing—how they’re enticing consumers into their stores once it is safe to do so. What can the in-store experience offer that online stores can’t? One way is to create engaging and immersive experiences by bringing digital aspects into the physical shop.

An example of one retailer who did this was Reebok. The shoe brand overcame the in-store feeling of ‘too much choice’ that can often intimidate consumers in the physical shop by installing self-service kiosks.

Combined with the expertise of human shop assistants, the store provided a better and more memorable buying experience for shoppers. It also meant Reebok didn’t miss out on their ability to learn from their customer’s behaviours.

As online shopping in Australia changes, so must the retail industry

Retailers can take the increase in online shopping as a queue to invest in their digital services. How consumers will choose to shop post-COVID-19 is difficult to predict. However, brands that provide seamless and informative online experience during a time of uncertainty will better position themselves to succeed.

Survey Methodology: Online Shopping In Australia Survey

Capterra wanted to understand how Australians are changing their online shopping habits in light of COVID-19. We surveyed people living in Australia, and over the age of 18-years-old. The panel includes:

- Full-time employees (54%)

- Part-time employees (23%)

- Freelancers (3%)

- Students (5%)

- People in retirement (12%)

- People who lost their job due to the pandemic (3%).

The participants come from various business sectors and levels of seniority. The panel includes 58% female and 42% male respondents. Incomes ranged from less than $15,000 per annum to more than $201,000 per annum.

The Online Shopping Habits in Australia survey ran between 14th and 22nd of July.