Before the world was hit by the coronavirus pandemic, the Australian highstreet was already struggling. In an adapt-to-survive strategy, much of the retail world made the important decision to invest more in eCommerce strategies. Capterra’s Social Commerce Report of 1,020 respondents highlights how Australian consumers are also turning to social media to shop in light of COVID-19.

In this article, we reveal the key insights that will help retailers get started with social commerce through social networks and traditional eCommerce software platforms. But first, let’s go over some of the basics of social selling.

What is social commerce?

Social commerce, also known as social shopping and social selling, is an eCommerce term used to describe the online buying activity that takes place across social networks.

Over the years, social networks have merged further into the consumer’s shopping experience. Today, businesses can sell directly to customers through social channels on a global scale as well as targeting local customers.

Types of social commerce:

The most popular types of social commerce channels include:

- Snapchat: Users can search and shop from the app.

- Instagram: Businesses can add buy buttons on posts as well as shoppable stories.

- Facebook Marketplace: Users can geotarget and purchase products in local areas.

- Pinterest: Displays the prices of products via product pins.

- TikTok: Influencers can place shoppable URLs within their video posts.

Social commerce also includes selling through forums and groups, chatbots (like you’d find on WeChat or Facebook Messenger), and other means. There are many types of social commerce platforms today, but primarily, they can be defined as any social network that allows for purchases and electronic payments.

How does social commerce work?

Social commerce works by streamlining the shopping experience for social media users. Essentially, the purchase path comes down to three steps: See, click, and pay.

Imagine a user sees a hat they like through an Instagram advert. They can then click on the buy button and order the hat. The payment process is conducted solely through Instagram, rather than them heading to the brand’s website or retail store to make the purchase.

Allowing users to shop from the social media platform reduces the buying journey for the customer. For the consumer, this is both time-saving and convenient.

What are the benefits of social commerce for brands?

1. Social media is a consistently expanding marketplace

Social media users are growing every day. Taking Instagram as an example, there are already 500 million active users of the app. Of these, half are logging into the app every day and actively engaging on it—and according to the platform, this number keeps climbing.

Instagram also says that:

- 60% of people discover new products on Instagram.

- More than 200 million Instagram users visit a business profile daily at least once.

- 130 million users tap on shopping posts in the app every month.

As the marketplace grows, social networks are continuously developing their commerce offering. Facebook, for example, has recently launched a range of new tools to help brands showcase their products. One of these includes the launch of ‘Storefronts’ which allows brands to tag products in their posts, similar to Instagram, and let customers browse their product range on a brand’s profile.

2. Brands can follow in-store customers onto digital alternatives & reach new audiences

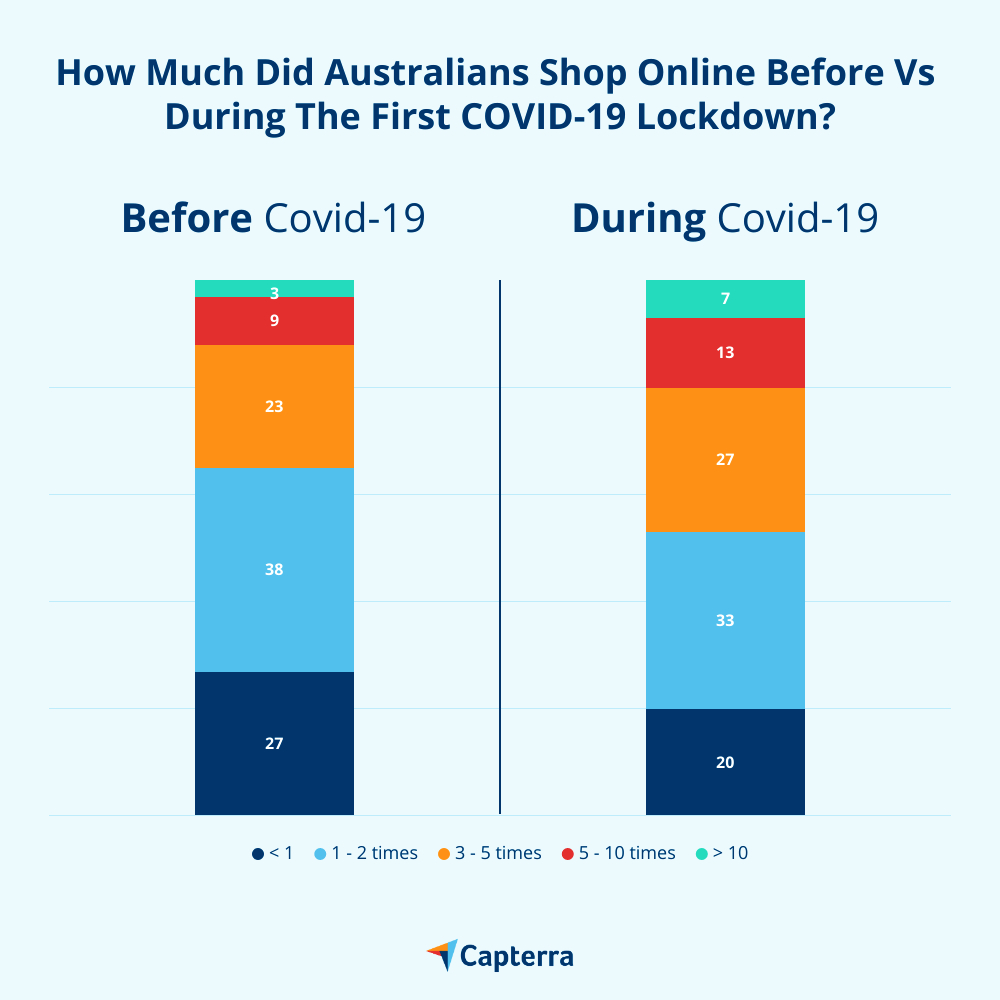

Capterra’s survey highlights how the majority of Australian shoppers shopped online more during the COVID-19 lockdown than before:

According to Marc Charlery, Head of Digital Product at Impressive Digital Agency, most brick and mortar stores will lose out on loyal in-store customers because of social distancing rules. However, he explains how social commerce may help retailers reach those people who cannot or feel reluctant to shop in-person:

‘Not only are people in lockdown and looking for stimulation, but there are many people working from home who may previously not have been in a position to look at their phones during the working day.

Using social media for eCommerce provides an opportunity for brands to still connect with audiences they may have previously interacted with in a physical sense, while also reaching new audiences.’

3. Increased brand usage of social commerce is driving media costs down

As people are forced to stay home, Australians are spending more time on social media at an increased frequency and for longer periods.

In light of COVID-19, Jacob Arnott, managing director We The People agency, explains how this has led to his clients paying less than normal to advertise on social networks:

‘As a result of this increase in attention, we’re seeing the cost of advertising on social platforms decrease, providing brands more value for their investments. In April, we saw the Cost-per-Mile (CPM) reduce 35% compared to the same time last year, as a result of increased attention on Facebook. Advertising on social platforms has always been highly cost-effective; however, this recent reduction in CPM is reflective of the further value on offer to brands.’

In particular, Jacob draws attention to the rise of Tik Tok. The platform has quickly become one of Australia’s most popular social media platforms, with Australian users spending an average of 62 minutes on the platform each day. He explains:

‘Leveraging TikTok’s new advertising platform, we’ve been impressed by the cost-effective results the platform has delivered for several of our clients across various industries.’

4. Social commerce is highly-measurable

A huge benefit of social shopping for brands is that it’s easy to set clear, measurable performance indicators. This helps inform retailers how they develop their product line in the future, as well as which social media marketing posts drive most sales.

Clare Stevens, Social Director from Crunchy Social agency, elaborates on this advantage:

‘Social media allows brands to test their strategies, learn from their results and continually improve their marketing in order to attract sales. Establishing an understanding of the brand’s social analytics can allow for better buying, faster logistics and better brand management in the future.’

What are the challenges of social selling?

The main challenges of social selling include:

- Increasing competitiveness: Social shopping is on the rise, and as a result, social platforms are continuously bringing to market new features and updates. More and more brands will likely want to take advantage of this trend.

- Lack of expertise: Brands must take care to research the social commerce market and put the right strategy in place before diving in blind. Otherwise, they risk making little to no profit on their efforts.

- Handling of logistics: Brands need to think ahead about fulfilling deliveries effectively, quickly, competitively and conveniently. Not being prepared to handle an increase in orders could jeopardize the service brands provide to customers.

For those who are new to social commerce, read on to discover how best to get started.

Where brands should begin with social commerce

1. Understand the key demographics shopping on social networks

The benefit of social commerce is that features like buy buttons enable businesses to take the ‘sales talk’ out of selling on social. Instead of writing sales slogans, brands should focus on creating enticing imagery and writing engaging captions.

To do this, brands must first understand the demographic of their potential customer. Capterra surveyed 1,020 Australian consumers about their online shopping habits. To see a detailed methodology of the survey, skip to the bottom of this article.

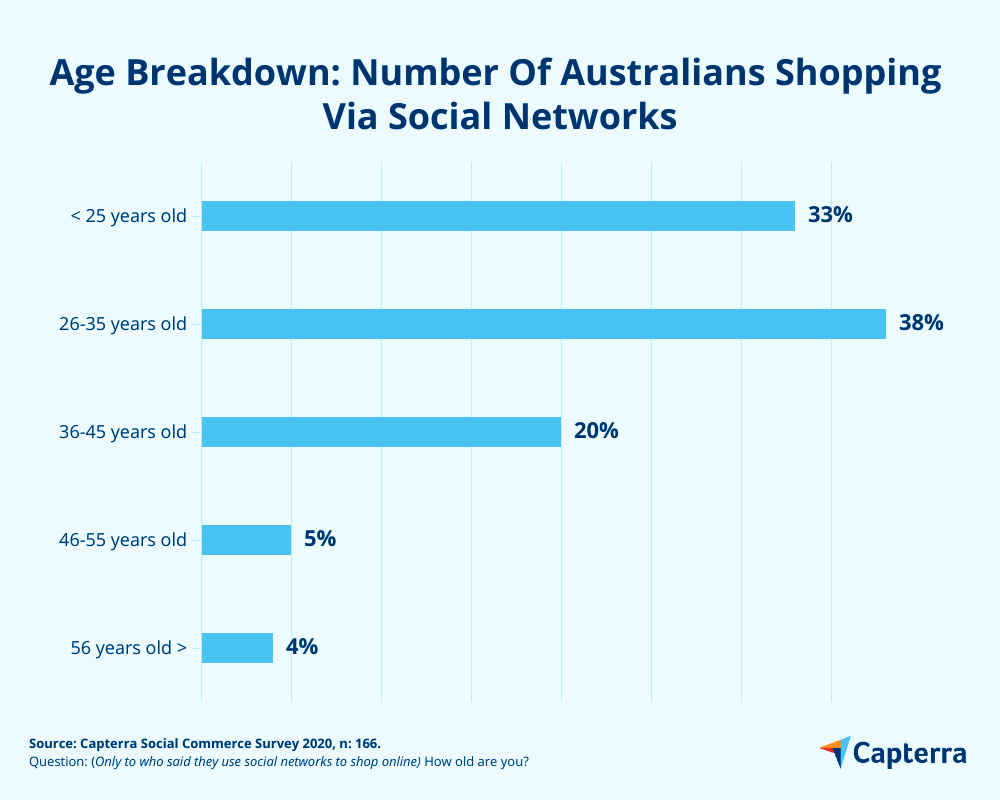

Of the 18% of all respondents who said they have shopped on social, here were the dominating demographics:

71% were under 35-years-old

Millennials and Generation Z are the primary social commerce demographics. With this in mind, social media makes a solid choice for brands that target or plan to target these age groups.

Bear in mind that 20% of the respondents were between 36-45-years-old. However, consumers aged above this aren’t yet privy to social shopping.

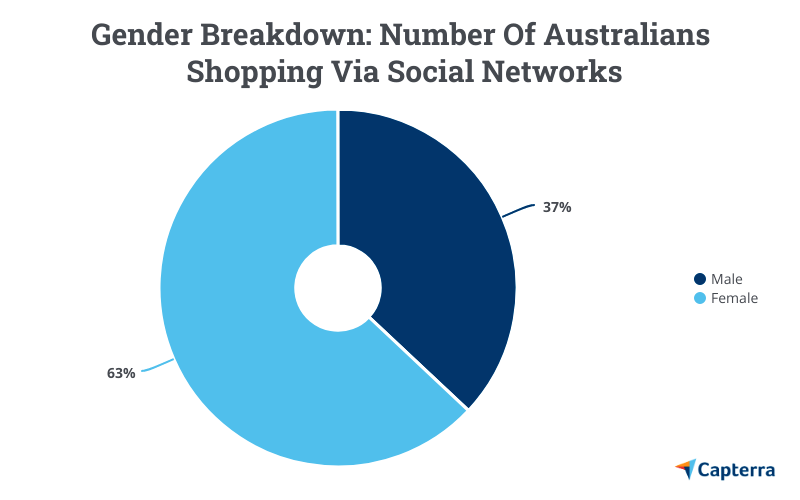

Around two-thirds are female

Capterra’s survey highlighted that 63% of social media shoppers are female and 37% were male.

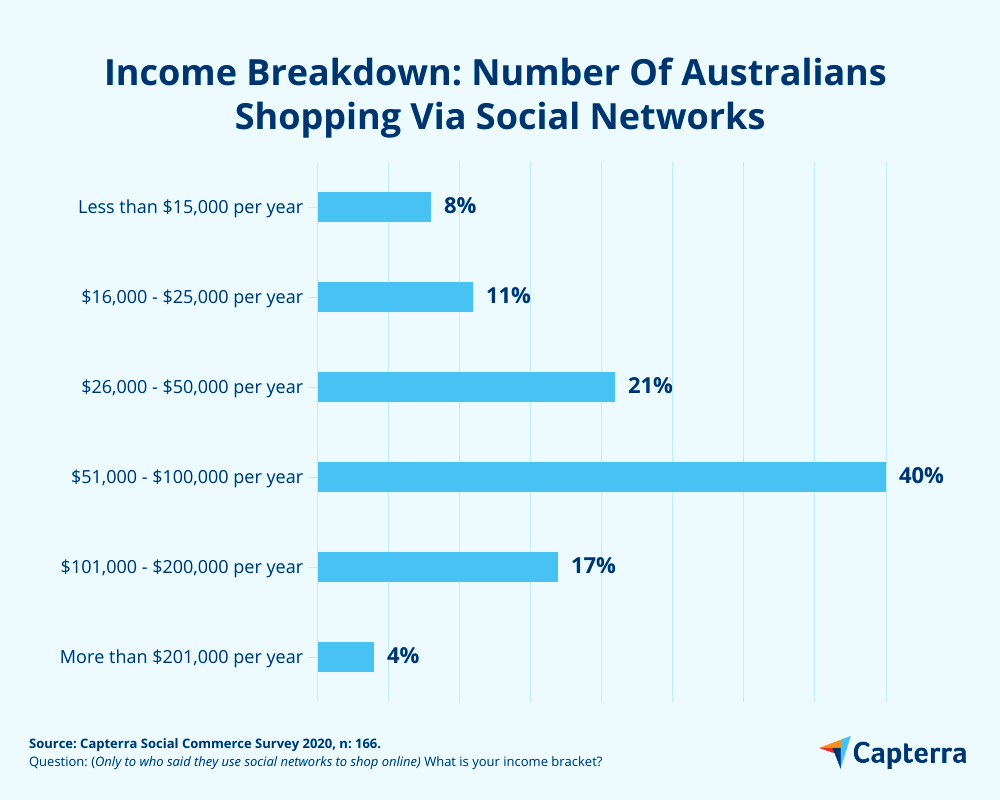

75% are earning regular incomes

When looking at the spending potential for Australians that shop via social networks, Capterra found that:

- 63% are employed full-time, therefore earning a regular salary.

- 22% are employed part-time, earning a lesser but regular income.

- 72% earn more $16,000 but less than $100,000 per year.

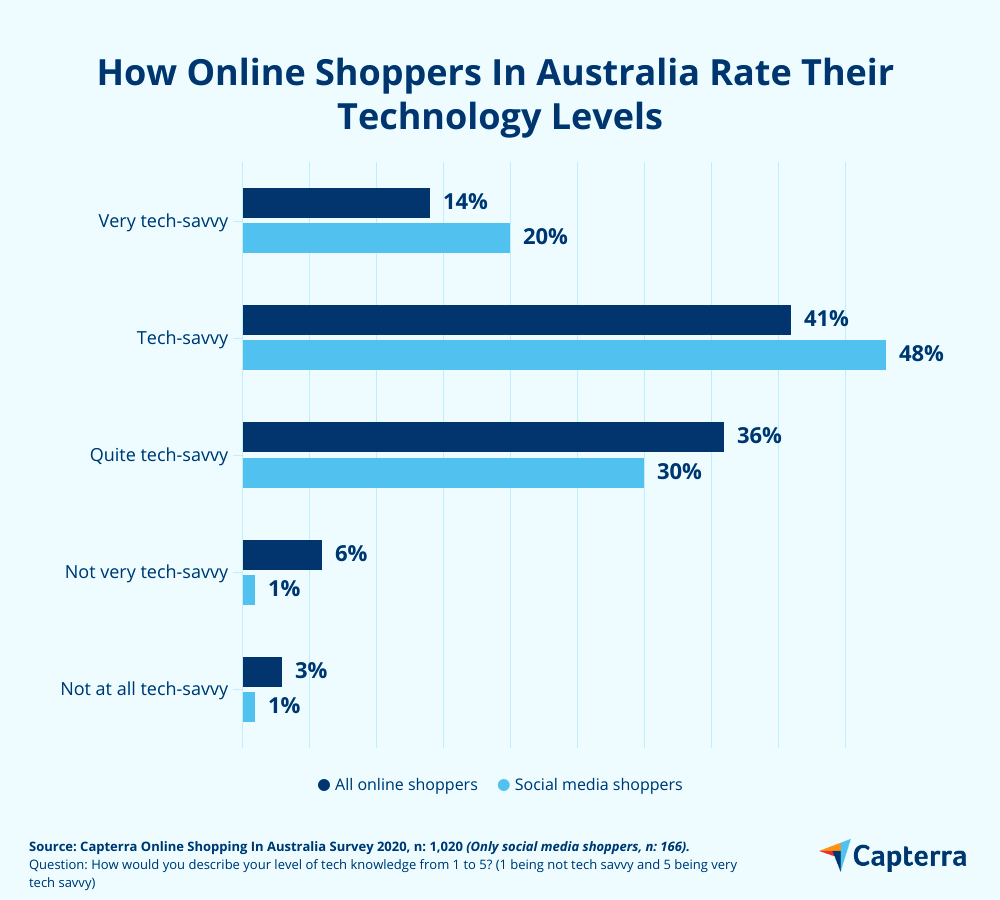

98% are confident with technology

91% of Capterra’s 1,020 respondents rated themselves as tech-savvy—ranging from quite tech-savvy to very tech-savvy. However, social media shoppers are more confident than your average online shopper.

When looking at the level of their technology-savviness, social shoppers rank their abilities at the upper end of the spectrum.

86% believe their shopping behaviour has changed for good due to the crisis

Respondents that said they shop via social networks said they believe they’re shopping habits have changed. Delving further into the topic:

- 39% said they will buy more online than they did before.

- 36% said they’ll buy more products online that they used to buy in-person.

- 11% want to avoid going to physical shops due to risk of infection.

- 14% don’t expect their online shopping habits to change at all.

2. Start with your best sellers

Social media management platform, Buffer, recommends that brands new to social selling start with their best, lowest cost products. The company explains the logic behind this strategy: ‘It makes sense that lowest-cost products might sell best on social media. You’re capturing people at a certain place in their buyer journey where they’re eager to buy, not eager to weigh the pros and cons of a major purchase.’

Breaking it down further, selling the ‘best’ products—AKA the products that have already proven to be highly desirable to your existing customers based on sales and reviews—will improve your chances of appealing to a wider audience. Focusing on the least expensive of those products helps reduce thinking friction for shoppers who are browsing more passively.

It’s also useful for newer social sellers to understand the most successful business verticals. According to a 2019 eMarketer report, the most popular categories for social commerce include apparel, luxury goods, beauty, and home decor.

3. Leverage eCommerce software for social selling

Many eCommerce software platforms already allow for integration with social networks. If you’re already using this type of technology, check whether this integration is possible because it will allow you to automate updates to your social store as you make changes to your website store’s back-end system. This approach would work well for brands with a wide range of FMCG products that they want to advertise on social media.

Brands that don’t have an eCommerce platform, or would prefer not to, can still sell products through social media platforms without one. However, this method is recommended mainly for retailers who have few products because the catalogue will need to be created and managed manually.

4. Choose the right influencers

Influencers and your community come hand-in-hand in social commerce. Influencers help to promote brand stories while social media communities help to amplify the noise. But choosing the wrong influencer may come across inauthentic to followers, or encourage followers to promote the wrong messages.

Clare from Crunchy Social gave her advice to brands exploring this avenue:

‘Success with influencer marketing depends greatly on the offering of the business and its audience. It is important for businesses to first assess the metrics of the influencer and outline any expectations from the influencer or brand from the beginning. Businesses should also consider other ways they could effectively gain reach, such as through targeted advertising on social media or competitions.’

5. Measure its success

The ultimate goal of social commerce is to drive more sales and positively impact the store’s bottom line. To measure this, tracking procedures need to be put in place. As well as measuring how much revenue is coming from your social commerce vertical, it’s worth measuring how many users are viewing and engaging with posts. Not all of your audience may be ready to shop yet when they view a post, so having this data available gives brands a benchmark to work from to drive higher conversion rates.

Methodology for Social Commerce Report 2020

Capterra wanted to understand how online shopping habits in Australia are shifting in light of COVID-19. We surveyed consumers living in Australia, and over the age of 18-years-old.

The full panel of 1,020 respondents includes 58% female and 42% male respondents. Incomes ranged from less than $15,000 per annum to more than $201,000 per annum. The participants also came from various business sectors and levels of seniority.

To understand how many respondents had shopped through social networks, we asked: Have you ever shopped by using any of the following emerging technologies?

18% of the total respondents said they have shopped on social media. To obtain demographic information for these respondents, we set a filter to review only these answers.

The Online Shopping Habits in Australia survey ran between 14th and 22nd of July.

‘Not only are people in lockdown and looking for stimulation, but there are many people working from home who may previously not have been in a position to look at their phones during the working day.

‘Not only are people in lockdown and looking for stimulation, but there are many people working from home who may previously not have been in a position to look at their phones during the working day. ‘As a result of this increase in attention, we’re seeing the cost of advertising on social platforms decrease, providing brands more value for their investments. In April, we saw the Cost-per-Mile (CPM) reduce 35% compared to the same time last year, as a result of increased attention on Facebook. Advertising on social platforms has always been highly cost-effective; however, this recent reduction in CPM is reflective of the further value on offer to brands.’

‘As a result of this increase in attention, we’re seeing the cost of advertising on social platforms decrease, providing brands more value for their investments. In April, we saw the Cost-per-Mile (CPM) reduce 35% compared to the same time last year, as a result of increased attention on Facebook. Advertising on social platforms has always been highly cost-effective; however, this recent reduction in CPM is reflective of the further value on offer to brands.’ ‘Social media allows brands to test their strategies, learn from their results and continually improve their marketing in order to attract sales. Establishing an understanding of the brand’s social analytics can allow for better buying, faster logistics and better brand management in the future.’

‘Social media allows brands to test their strategies, learn from their results and continually improve their marketing in order to attract sales. Establishing an understanding of the brand’s social analytics can allow for better buying, faster logistics and better brand management in the future.’